What are balloon loans, and when are they used?

Understanding Balloon Loans

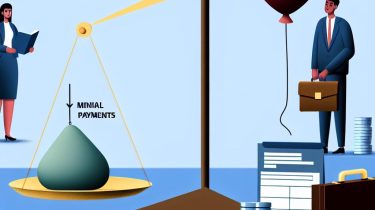

Balloon loans are a specific type of loan arrangement where the borrower commits to making regular payments over the loan term. However, unlike traditional loans, in which payments are evenly distributed throughout the term, a balloon loan culminates in a significantly larger payment at the end of the term, known as the balloon payment. Due to their initial lower payment requirements, balloon loans are often utilized in various financial scenarios.

Structure of Balloon Loans

In the initial stages of a balloon loan, borrowers make smaller regular payments. These payments usually cover either the interest or a combination of interest and a small portion of the principal. The defining feature of a balloon loan is the considerable remaining balance payable at the end of the loan term, representing the balloon payment, which is typically substantial compared to earlier payments.

Example of a Balloon Loan

Imagine a borrower takes out a balloon loan for $100,000 with an interest rate of 5% over a 5-year period. The borrower might make small monthly payments based on an amortization schedule extending over 30 years, yet at the conclusion of the 5-year term, the remaining loan balance must be paid in full. This remaining balance predominantly represents the principal sum, as the borrower has largely been paying off only the interest or minimal principal amounts throughout the term of the loan.

Common Uses of Balloon Loans

Balloon loans are often employed in situations where borrowers anticipate an increase in cash flow in the future or plan to refinance before the end of the loan term. Below are some typical applications:

Real Estate and Mortgages: In real estate, balloon mortgages serve homebuyers who expect their income to rise or have plans to sell the property before the balloon payment comes due. This type of loan can enable buyers to purchase larger homes than they might otherwise afford at the time of purchase.

Commercial Real Estate: For businesses, balloon loans are utilized to finance large commercial projects with an expectation of revenue growth over time. The reduced initial costs are particularly advantageous in capital-intensive development efforts.

Advantages and Considerations

The main advantage of balloon loans lies in the reduced payments initially required. This can afford individuals or businesses greater financial flexibility in the short term, proving beneficial in cases where future income is expected to increase or when a one-time cash influx is anticipated, rendering the final large payment more feasible.

Despite these benefits, potential risks must be carefully considered. A borrower needs to be prepared for the large financial outlay at the end of the loan term. If the expected funds do not emerge, the balloon payment can become a significant financial burden. Inability to meet the balloon payment obligations can lead to default, bringing about financial and legal consequences.

Conclusion

Prospective borrowers should approach balloon loans with careful financial planning and risk management. While such loans can offer appealing advantages under certain circumstances, they necessitate a well-defined strategy for managing the large final payment. Engaging with a financial expert or mortgage advisor can help borrowers thoroughly assess their ability to meet the loan’s terms. For a deeper exploration of financial planning related to balloon loans, visiting reputable financial resources like Investopedia or consulting with a licensed financial advisor is advisable.

Understanding the intricacies of balloon loans involves considering the balance between the immediate benefits and the future obligations. By doing so, borrowers can make informed decisions that align with their long-term financial goals. This foresight ensures not only the maximization of current financial capabilities but also the mitigation of future financial challenges. Balloon loans thus represent a pivotal financial tool when used judiciously and planned with diligence. In pursuit of adopting a balloon loan strategy, thorough comprehension and preparedness stand as key pillars to successful financial stewardship.

The journey with a balloon loan is far more than a mere exercise of choosing a type of loan; it involves strategic financial navigation to harness the opportunities provided while mitigating potential adverse outcomes. This careful planning and preparation can empower borrowers to master the art of balloon loans, turning a daunting financial commitment into a manageable and beneficial element of their financial strategy. By staying informed and proactive, borrowers can take full advantage of the flexibility offered by balloon loans while safeguarding their future financial stability.

This article was last updated on: March 24, 2025